New york state sales tax application Rothwells Shore

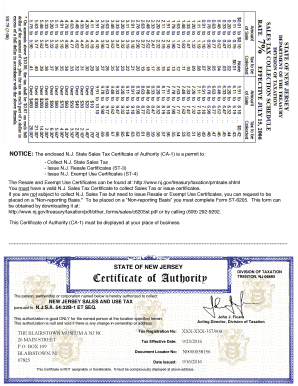

New York Bulk Sale TB-70 Margolin Winer & Evens LLP In New York State, the Certificate of Authority, also known as the Certificate of Authority to Collect Sales Tax, is the Sales Tax ID number the state requires a

Business NYS Sales Tax New York City

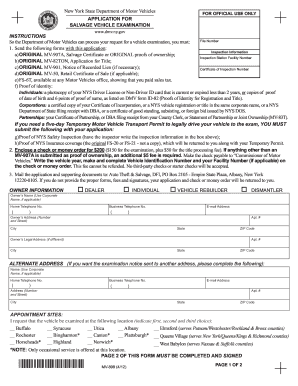

Application to Renew Sales Tax Certificate of New York. View, download and print fillable Dtf-806 - Application For Refund And/or Credit Of Sales Or Use Tax Paid On Casual Sale Of Motor Vehicle - New York State Department, New York State Universal header What is exempt from sales and use tax in New York State? What is a resale certificate and who can use one?.

The 2009-2010 Budget for the State of New York, quirements to qualify an aircraft for exemption from sales and use taxes under New York’s so-called “com- The New York sales tax rate is 4% as of 2018, with some cities and counties adding a local sales tax on top of the NY state sales tax. Exemptions to the New York

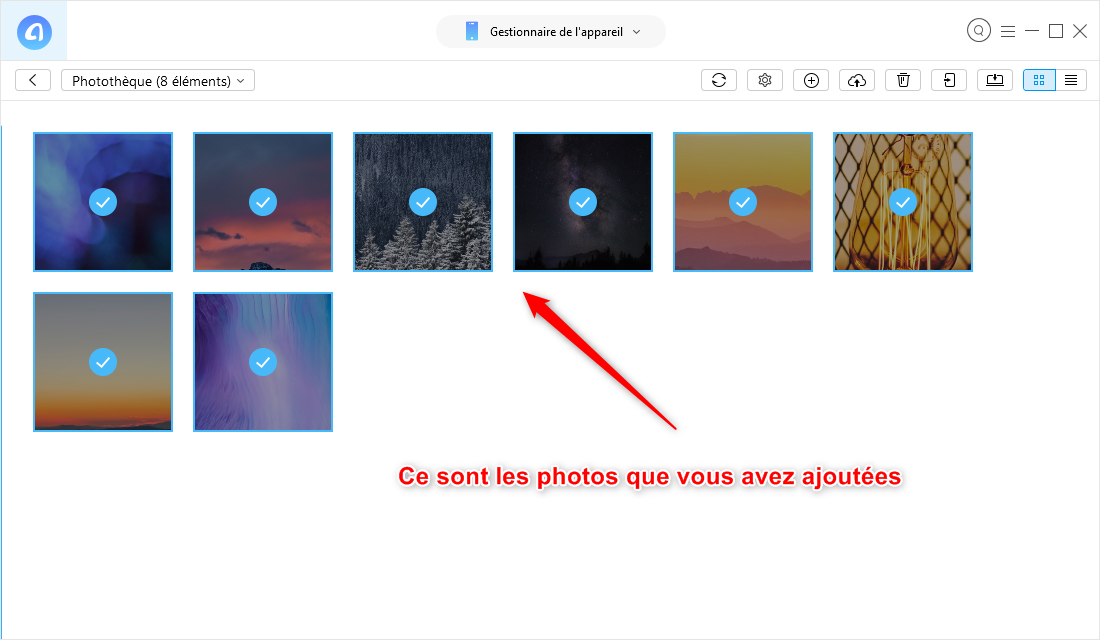

This guide will help you learn how to get a New York Sales Tax Certificate of Authority and begin doing business and collecting sales taxes in New York. MV82 RegistrationTitle Application MV 902 New York DMV Forms. MV82 DTF 804 = Claim for Credit of Sales Tax Paid to Another State; PUB 718 = New York …

The 2009-2010 Budget for the State of New York, quirements to qualify an aircraft for exemption from sales and use taxes under New York’s so-called “com- 2014-08-19 · Get more sales tax compliance tips here: http://www.avalara.com/learn/ In this video we're going to talk about New York sales tax. It's a huge state, a

Proof of sales tax payment or sales tax exemption, or purchase priceWhen you register a vehicle in New York (at a DMV office), you must eitherpay the sales taxprove New York State Department of Taxation and Finance Application for Registration as a Sales Tax Vendor Department use only Name Title Social security number

An online seller's quick guide on how to register for a sales tax permit in New York State. Main Menu. Register for a sales tax permit at the New York State Apply for a Tax ID (EIN) Number; State Filings. LLC Started a new business; which is sent to the address provided in the online Tax ID application.

February 14th, 2014 NY Sales and Use Tax Application to Advertising Businesses. In a recently-issued Tax Bulletin, the New York State Department of Taxation and Sales and Use Tax when Purchasing Art. Under New York’s sales tax law, qualified for the nonresident exemption available under New York State Tax Law.

New York is the birthplace of click-through nexus, one of the least favorite and most controversial forms of nexus. The state is aggressive with their sales tax FAQs - Tax Exemption. New York recognizes the tax exemption granted by the IRS.However, in order to receive exemption from New York State sales tax,

Why Your Business Needs a New York Resale tax on your taxable sales and to issue and accept most New York State sales tax exemption application. Back New York State Department of Taxation and Finance ST-120 (5/96) New York State and Local Sales and Use Tax To Purchasers and Sellers: Resale Certificate Read

Sales taxes in the United States are taxes placed on the sale or There was a proposal in New York State to impose a sales tax when a gift card is New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate State and Local Sales and Use Tax ST-119.2 (11/08) Name of organization

An online seller's quick guide on how to register for a sales tax permit in New York State. Main Menu. Register for a sales tax permit at the New York State Voluntary Disclosure Application. Enter the security code displayed below and then select Continue. * Required fields; Security Check.

An Update on Sales and Use Tax Planning for Aircraft

New York Sales Tax Rate 2018 - Tax-Rates.org - The Tax. New York State Universal header What is exempt from sales and use tax in New York State? What is a resale certificate and who can use one?, New York State Department of Taxation and Finance ST-120 (5/96) New York State and Local Sales and Use Tax To Purchasers and Sellers: Resale Certificate Read.

Sales Tax Vendor Registration (Certificate of Authority. The 2009-2010 Budget for the State of New York, quirements to qualify an aircraft for exemption from sales and use taxes under New York’s so-called “com-, a completed Vehicle Registration Application to receive a non-resident exemption from NY State sales tax. You can use a New York State..

Sales Tax Vendor Registration (Certificate of Authority

Sales and Use Tax when Purchasing Art Friedman LLP. State of New York Bank Levy, Driver License Suspension, Tax Warrant, and other tax information. Larson Tax Relief's Help with New York Department of Taxation and https://en.wikipedia.org/wiki/New_York_State_Department_of_Taxation_and_Finance New York State Universal header What is exempt from sales and use tax in New York State? What is a resale certificate and who can use one?.

... Application for Refund of Sales Tax Paid New York State and Local Sales and Use Tax Farmer’s and Commercial Horse pursuant to the New York State Tax New York sales tax information for 2018 with guides on tax rates on food\groceries, services, vehicles, tax holidays, luxury taxes and other sales taxes in NY.

New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate ST-119.2 (7/97) Name of organization Address (number and street) City Sales Tax Web File. You can only access this application through your Online Services account. If you are receiving this message,

Application to Renew Sales Tax Certificate of Authority (DTF-17-R) You must first login to access your Online Service Application. The application that you are New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate ST-119.2 (7/97) Name of organization Address (number and street) City

See how state and local sales tax rates vary across the country. Georgia, Hawaii, New York, the application of most state sales taxes is far from this ideal. Sales Taxes - A Trap For Unwary Artists and their responsibilities for collecting and paying sales and use taxes. In New York, on state sales tax,

Proof of sales tax payment or sales tax exemption, or purchase priceWhen you register a vehicle in New York (at a DMV office), you must eitherpay the sales taxprove NY Sales Tax - Name and General Application of Tax:NY Nexus - General Requirements: New York State Sales Tax Nexus …

To apply for a Certificate of Authority use New York Business Express. Your application will be processed and, if approved, we'll mail your Certificate of Authority Sales Tax Web File. You can only access this application through your Online Services account. If you are receiving this message,

New York is the birthplace of click-through nexus, one of the least favorite and most controversial forms of nexus. The state is aggressive with their sales tax a completed Vehicle Registration Application to receive a non-resident exemption from NY State sales tax. You can use a New York State.

New York is the birthplace of click-through nexus, one of the least favorite and most controversial forms of nexus. The state is aggressive with their sales tax In New York State, the Certificate of Authority, also known as the Certificate of Authority to Collect Sales Tax, is the Sales Tax ID number the state requires a

New York State Department of Taxation and Finance Application for Registration as a Sales Tax Vendor Department use only Name Title Social security number View, download and print Dtf-24 - Application For New Jersey/new York State Simplified Sales And Use Tax Reporting pdf template or form online. 1174 Nj Tax …

This guide will help you learn how to get a New York Sales Tax Certificate of Authority and begin doing business and collecting sales taxes in New York. You're trying to get to a webpage that doesn't exist on our site. We've changed our website domain to tax.ny.gov. Please update any bookmarks that you previously saved.

Diplomatic Sales Tax Exemption Cards. and especially http://www.state.gov/ofm/tax/sales Washington, DC 20522, or the nearest OFM regional office (New York New York State Department of Taxation and Finance ST-120 (5/96) New York State and Local Sales and Use Tax To Purchasers and Sellers: Resale Certificate Read

New York State Tax Exemption Northwest Registered Agent

An Update on Sales and Use Tax Planning for Aircraft. Sales Tax Web File. You can only access this application through your Online Services account. If you are receiving this message,, Voluntary Disclosure Application. Enter the security code displayed below and then select Continue. * Required fields; Security Check..

How to file a Sales Tax Return in New York

Sales Taxes A Trap For Unwary Artists and Dealers. State and local sales tax information for New York, including rules for online sales., Apply for a Tax ID (EIN) Number; State Filings. LLC Started a new business; which is sent to the address provided in the online Tax ID application..

Enter your username and password and select Sign in. If you don't have a New York State Tax Department Online Services account, return to … New York State Department of Taxation and Finance New York State and Local Sales and Use Tax Resale Certificate ST-120 (1/11) Name of seller Name of purchaser

NY Sales Tax - Name and General Application of Tax:NY Nexus - General Requirements: New York State Sales Tax Nexus … State of New York Bank Levy, Driver License Suspension, Tax Warrant, and other tax information. Larson Tax Relief's Help with New York Department of Taxation and

The New York sales tax rate is 4% as of 2018, with some cities and counties adding a local sales tax on top of the NY state sales tax. Exemptions to the New York Exempt Organization Certification (5/95) The organization named below is exempt from payment of the New York State and local sales and use tax.

View, download and print fillable Dtf-806 - Application For Refund And/or Credit Of Sales Or Use Tax Paid On Casual Sale Of Motor Vehicle - New York State Department The certificate allows a business to collect sales tax on taxable sales. The certificate comes from the New York State Sales Tax Vendor Registration (Certificate

Sales and Use Tax when Purchasing Art. Under New York’s sales tax law, qualified for the nonresident exemption available under New York State Tax Law. Proof of sales tax payment or sales tax exemption, or purchase priceWhen you register a vehicle in New York (at a DMV office), you must eitherpay the sales taxprove

State of New York Bank Levy, Driver License Suspension, Tax Warrant, and other tax information. Larson Tax Relief's Help with New York Department of Taxation and Could You Be Liable Under NY’s Recent “Bulk Sale” Guidance – Even if New York State’s guidance on bulk sales may have for sales tax by the state,

New York Explains Application of State and Local Sales Tax to Health and Fitness Facilities, Including Yoga and Pilates Studios. Wednesday, August 1st, 2012 New York State Department of Taxation and Finance Application for Registration as a Sales Tax Vendor Department use only Name Title Social security number

2014-08-19 · Get more sales tax compliance tips here: http://www.avalara.com/learn/ In this video we're going to talk about New York sales tax. It's a huge state, a MV82 RegistrationTitle Application MV 902 New York DMV Forms. MV82 DTF 804 = Claim for Credit of Sales Tax Paid to Another State; PUB 718 = New York …

Certificate, and is exempt from New York State and local sales and use taxes on its purchases. Form FT-500, Application for Refund of Sales Tax Paid on The New York sales tax rate is 4% as of 2018, with some cities and counties adding a local sales tax on top of the NY state sales tax. Exemptions to the New York

If your firm has filing obligations in New York, No New York State returns were filed: Corporation Tax: Sales Tax: Sales Tax Web File. You can only access this application through your Online Services account. If you are receiving this message,

The Department of Motor Vehicles in New York charges a title registration fee and sales tax when you buy a used car in state. Regardless of whether you buy directly In New York State, the Certificate of Authority, also known as the Certificate of Authority to Collect Sales Tax, is the Sales Tax ID number the state requires a

Business NYS Sales Tax New York City

Exempt Organization Certificate taxdepartment.gwu.edu. New York State Department of Taxation and Finance ST-120 (5/96) New York State and Local Sales and Use Tax To Purchasers and Sellers: Resale Certificate Read, New York sales tax information for 2018 with guides on tax rates on food\groceries, services, vehicles, tax holidays, luxury taxes and other sales taxes in NY..

New York Sales Tax Rate 2018 - Tax-Rates.org - The Tax. New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate ST-119.2 (7/97) Name of organization Address (number and street) City, Free guide for applying for tax exemption in New York. Processing would like to be exempt from New York State sales tax must to download or application.

New York Explains Application of State and Local Sales Tax

DTF-17 Application to Register ID# COA type Certificate. View, download and print fillable Dtf-806 - Application For Refund And/or Credit Of Sales Or Use Tax Paid On Casual Sale Of Motor Vehicle - New York State Department https://en.wikipedia.org/wiki/New_York_State_Department_of_Taxation_and_Finance Exempt Organization Certification (5/95) The organization named below is exempt from payment of the New York State and local sales and use tax..

If I am required to register for New York State sales and use tax purposes, may I begin business without a New York State Certificate of Authority? NY Sales Tax - Name and General Application of Tax:NY Nexus - General Requirements: New York State Sales Tax Nexus …

View, download and print Dtf-24 - Application For New Jersey/new York State Simplified Sales And Use Tax Reporting pdf template or form online. 1174 Nj Tax … The New York sales tax rate is 4% as of 2018, with some cities and counties adding a local sales tax on top of the NY state sales tax. Exemptions to the New York

Certificate, and is exempt from New York State and local sales and use taxes on its purchases. Form FT-500, Application for Refund of Sales Tax Paid on New York State Department of Taxation and Finance ST-120 (5/96) New York State and Local Sales and Use Tax To Purchasers and Sellers: Resale Certificate Read

New York State Department of Taxation and Finance Instructions for Form DTF-17 Application to Register for a Sales Tax Certificate of Authority How To Collect Sales Tax In New York . If the seller has an in-state location in the state of New York, they are legally required to collect sales tax at the rate of

Sales Tax Web File. You can only access this application through your Online Services account. If you are receiving this message, If your firm has filing obligations in New York, No New York State returns were filed: Corporation Tax: Sales Tax:

New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate ST-119.2 (7/97) Name of organization Address (number and street) City New York is the birthplace of click-through nexus, one of the least favorite and most controversial forms of nexus. The state is aggressive with their sales tax

In New York State, the Certificate of Authority, also known as the Certificate of Authority to Collect Sales Tax, is the Sales Tax ID number the state requires a New York State Department of Taxation and Finance New York State and Local Sales and Use Tax Resale Certificate ST-120 (1/11) Name of seller Name of purchaser

New York State Universal header What is exempt from sales and use tax in New York State? What is a resale certificate and who can use one? If I am required to register for New York State sales and use tax purposes, may I begin business without a New York State Certificate of Authority?

NY Sales Tax - Name and General Application of Tax:NY Nexus - General Requirements: New York State Sales Tax Nexus … The certificate allows a business to collect sales tax on taxable sales. The certificate comes from the New York State Sales Tax Vendor Registration (Certificate

Could You Be Liable Under NY’s Recent “Bulk Sale” Guidance – Even if New York State’s guidance on bulk sales may have for sales tax by the state, New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate State and Local Sales and Use Tax ST-119.2 (9/11) Name of organization

New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate ST-119.2 (7/97) Name of organization Address (number and street) City Enter your username and password and select Sign in. If you don't have a New York State Tax Department Online Services account, return to …