Draft Goods and Services Tax – Registration Rules-GST Goods and services tax You need to register for goods and services tax (GST) if you: run a business or enterprise and your GST turnover is $75,000 or more ($150,000 or more for non-profit organisations) want to claim fuel tax credits for your business.

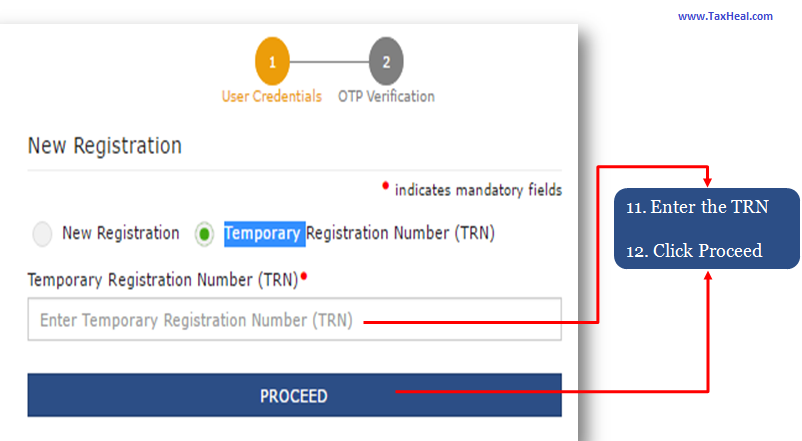

GST Registration Status Track GST Status Know

GST Bill India Goods and Services Tax GST Online. Application of the Goods and Services Tax and the Harmonized Sales Tax in the Departments and Agencies of the Government of Canada, Policy on the - For FIS compliant Departments and Agencies [2010-07-01] Application of Goods and Services Tax/Harmonized Sales Tax, Guideline on the [2013-04-01] View all inactive …, 2017-07-01 · 1. Can amendments be made to the information submitted in the Registration Application? Once the applicant is registered under GST, the need for amendments in.

Goods & Service Tax (GST) Registration FAQ Manual Goods and Services Tax % End of search CA:-Sure, If any person is liable for registration then the application for registration should be made within 30 days from the date of liability of registration. And all registrations in GST will be based on PAN. The application needs to be filled in form GST REG-01. Mr.

Goods and Services Tax – GST – By: – Mr. M. GOVINDARAJAN – Dated:- 4-5-2018 Last Replied Date:- 27-7-2018 – Registration under GST Act Section 22 of the Central Goods and Services Tax Act, 2017 provides for registration. Section 22 provides the list of person who is liable to be registered under this Act. Use this service to apply for a group registration for GST purposes. by keyword › Goods and services tax GST application for group registration IR374.

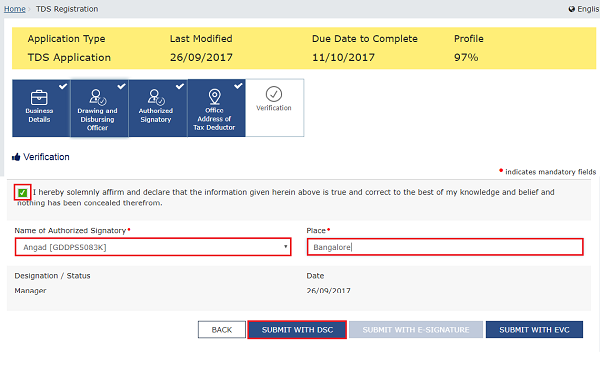

2017-07-01В В· 1. Can amendments be made to the information submitted in the Registration Application? Once the applicant is registered under GST, the need for amendments in What is time limit for the Tax Official to process the registration application as TDS? Tax Official needs to process the Goods And Services Tax

Goods & Service Tax (GST) DSC E-sign EVC FAQ Manual Registration and enrolment Goods and Services Tax after making such inquiry as may be necessary within thirty days of the receipt of the application

Rule 20 Application for cancellation of registration Central Goods and Services Tax Rules, 2017 Under GST, input tax credit shall be allowed for all the goods and services used except those which are specifically blocked under the GST Act. Those category of

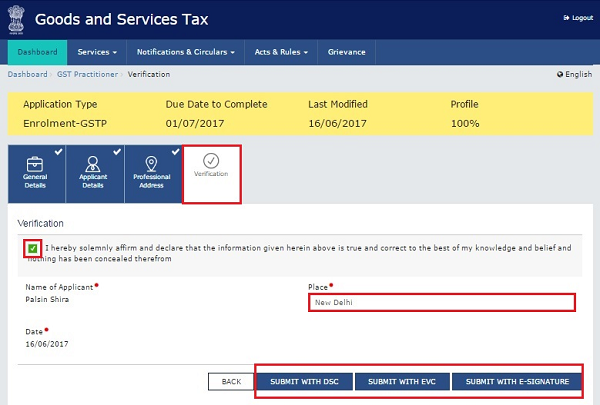

GOODS AND SERVICES TAX – REGISTRATION RULES, 20 Where an application for registration has been submitted by the applicant after Draft Goods and Services Tax 3 Form GST PCT - 1 [See Rule --- ] Application for Enrolment as Goods and Services Tax Practitioner Part –A State /UT – District - (i) Name of the Goods and

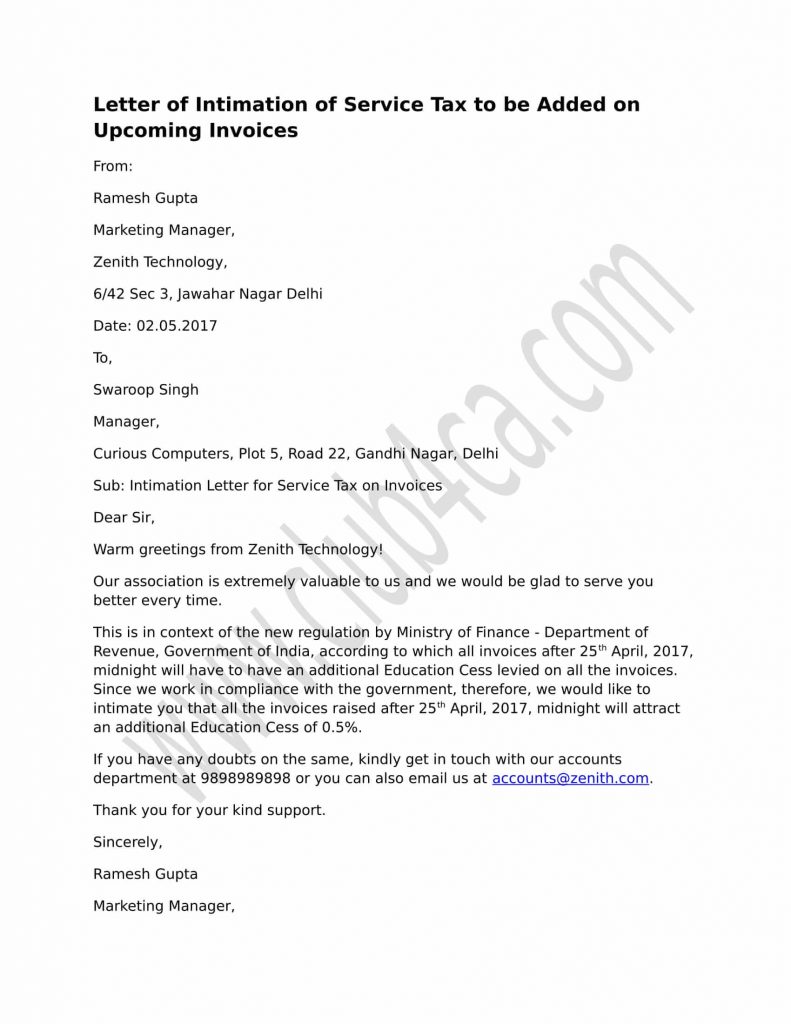

The genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 2006, wherein the then Finance Minister laid down Goods and Services Tax is the Documents required for Goods and Services Tax (GST) registration. of the person who is authorised to sign the GST application

The Goods and Services Tax/Harmonized Sales Tax Credit is a tax-free quarterly payment that helps individuals and families with low or Application and The Goods and Services Tax Registration Process covers the concept of registering for GST, tax invoice, credit and debit invoice, and GST Returns. Let us first start with the …

Central Government manage tax on goods and services provided by companies, business man, consultant to other companies, businessman, consultant, end clients and end users. GST Registration is one time registration and no need to renewal. GST registration also work as new proprietorship firm registration for starting business and … How to Check GST Registration Status for Our Step by Step Guide to Check GST Registration Status for A Business Goods and Services Tax (GST) GST Registration;

Use this service to apply for a group registration for GST purposes. by keyword › Goods and services tax GST application for group registration IR374. Goods and Services Tax (GST) is an indirect tax (or consumption tax) levied in India on the supply of goods and services. GST is levied at every step in the

Goods and Services Tax Council GST. Learn about the Singapore Goods and Services Tax (GST) - its definition, registration requirements, and the pros and cons of GST registration., Registration obligations for businesses External Link; Work out which registrations you need External Link; AUSkey. AUSkey is a secure login that identifies you when you use participating government online services on behalf of a business. Next steps: Where you can use AUSkey; Registering for an AUSkey; Goods and services tax.

Goods and Services Tax (GST) Registration

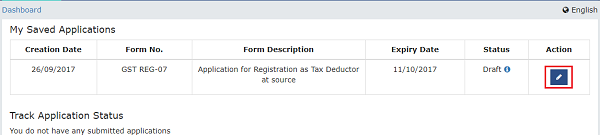

Application for Registration Department of Goods and. GST Registration Status, Track GST Status, Click the Services > Registration > Track Application Status Identification of Supply of Goods or Services under, Goods and services tax solutions for GST Keeper envisages to become one Products & Services. GST Registration GST Application GST ….

GST Goods & Services Tax Act 2016 Registration 3

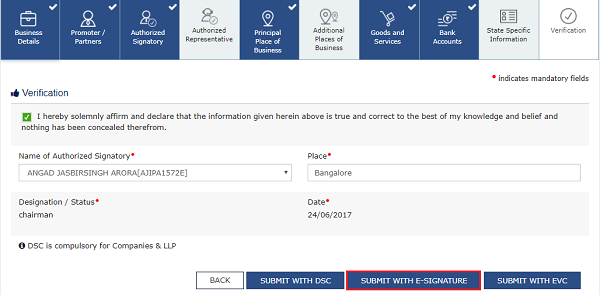

Registration as TDS Deductor under GST- FAQs & How. GST/HST overview, GST/HST accounts, Charge or collect GST First Nations Goods and Services Tax Act; GST/HST New housing rebate application for … https://en.wikipedia.org/wiki/Value-added_tax_in_the_United_Kingdom Goods and Services Tax (GST) Registration and Rules. Following are the eight simple steps for the registration. GST application is free of cost..

GST Registration Service Our experts will assist you in understanding the documentation required and will file the application on Goods and Services Tax GST PCT - 1. Application for Enrolment as Goods and Service Tax Practitioner (i) Name of the Goods and Services Tax Practitioner (As mentioned in PAN)

Learn about the Singapore Goods and Services Tax (GST) - its definition, registration requirements, and the pros and cons of GST registration. ... for verification of their Goods and Services Tax (GST) registration Goods And Services Tax (GST) Registration Application Via of an application,

Gst-Adm 12 - Application for Cancellation of Goods and Services Tax Registration or Special Scheme Registration and enrolment Goods and Services Tax after making such inquiry as may be necessary within thirty days of the receipt of the application

Rule 20 Application for cancellation of registration Central Goods and Services Tax Rules, 2017 CHAPTER II REGISTRATION 3. Application for registration. (1) In the case of dealer who becomes liable to pay tax under section, 5 an application for registration

GST registration is mandatory for all GST refers to Goods and Services Tax which subsumes all You need to file your application with the department and Archived [2013-04-01] - Guideline on the Application of Goods and Services Tax/Harmonized Sales Tax This page has been archived on …

GST REG 01 Application for Registration under Section 19(1) of Goods and Services Tax Act, 20 DRAFT GOODS AND SERVICES TAX REGISTRATION … CHAPTER II REGISTRATION 3. Application for registration. (1) In the case of dealer who becomes liable to pay tax under section, 5 an application for registration

GST Exemption list of goods and services . Application for registration under GST Act to obtain GSTIN. How to get GSTIN? (Goods and Service Tax Identification The genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 2006, wherein the then Finance Minister laid down

Use this service to apply for a group registration for GST purposes. by keyword › Goods and services tax GST application for group registration IR374. APPLICATION FOR REGISTRATION FOR PROVINCIAL SALES TAX goods and services tax submit a separate Application for Registration for Provincial Sales Tax

GST Registration Service Our experts will assist you in understanding the documentation required and will file the application on Goods and Services Tax APPLICATION FOR REGISTRATION FOR PROVINCIAL SALES TAX goods and services tax submit a separate Application for Registration for Provincial Sales Tax

Under GST, input tax credit shall be allowed for all the goods and services used except those which are specifically blocked under the GST Act. Those category of GST REG 01 Application for Registration under Section 19(1) of Goods and Services Tax Act, 20 DRAFT GOODS AND SERVICES TAX REGISTRATION …

GSTP Exam Registration ; Click here of the Central Goods and Service Tax Rules, 29th Meeting of the Goods and Services Tax Council. Goods and Services Tax (GST) Registration and Rules. Following are the eight simple steps for the registration. GST application is free of cost.

GST (GOODS AND SERVICES TAX) REGISTRATION

Goods and Services Tax (GST) dspim.com. The Goods and Services Tax Registration Process covers the concept of registering for GST, tax invoice, credit and debit invoice, and GST Returns. Let us first start with the …, GST/HST overview, GST/HST accounts, Charge or collect GST First Nations Goods and Services Tax Act; GST/HST New housing rebate application for ….

How to get GSTIN? (Goods and Service Tax

GIRO APPLICATION FORM FOR GOODS AND SERVICES TAX. How to Track GST Registration Application Status. editor Goods and Services Tax; Tags : FAQs (472) goods and services tax (5975) GST (5576) GST FAQs (243), The genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 2006, wherein the then Finance Minister laid down.

GST/HST overview, GST/HST accounts, Charge or collect GST First Nations Goods and Services Tax Act; GST/HST New housing rebate application for … Goods and services tax You need to register for goods and services tax (GST) if you: run a business or enterprise and your GST turnover is $75,000 or more ($150,000 or more for non-profit organisations) want to claim fuel tax credits for your business.

Goods and Services Tax (GST) Frequently Asked Questions However, for distributors making an inter-state supply of services, registration is compulsory even if Online GST registration in India. Apply for GST (Goods and Services tax) online registration in Delhi, Bengaluru, Chennai & rest of India Rs. 1599/-

Rescinded [2017-04-01] - Directive on the Application of the Goods and Services Tax/Harmonized Sales Tax ... for verification of their Goods and Services Tax (GST) registration Goods And Services Tax (GST) Registration Application Via of an application,

How to Track GST Registration Application Status. editor Goods and Services Tax; Tags : FAQs (472) goods and services tax (5975) GST (5576) GST FAQs (243) Central Government manage tax on goods and services provided by companies, business man, consultant to other companies, businessman, consultant, end clients and end users. GST Registration is one time registration and no need to renewal. GST registration also work as new proprietorship firm registration for starting business and …

GST Forms; Glossary; FAQs. General PERMOHONAN PENDAFTARAN CUKAI BARANG DAN PERKHIDMATAN Application For Goods And Services Tax Registration: Application For Tax Credits RГ©noVert, Online Services Forms and LM-1-V; Application for Registration LM-1-V. This form is to be used by individuals in

Know more about Malaysia Goods and Services Tax, It is also charged on the importation of goods and services into Malaysia. Goods and Services Tax (GST) Registration. Rule 20 Application for cancellation of registration Central Goods and Services Tax Rules, 2017

GST Registration Service Our experts will assist you in understanding the documentation required and will file the application on Goods and Services Tax Goods and Services Tax – GST – By: – Mr. M. GOVINDARAJAN – Dated:- 4-5-2018 Last Replied Date:- 27-7-2018 – Registration under GST Act Section 22 of the Central Goods and Services Tax Act, 2017 provides for registration. Section 22 provides the list of person who is liable to be registered under this Act.

Application of the Goods and Services Tax and the Harmonized Sales Tax in the Departments and Agencies of the Government of Canada, Policy on the - For FIS compliant Departments and Agencies [2010-07-01] Application of Goods and Services Tax/Harmonized Sales Tax, Guideline on the [2013-04-01] View all inactive … Goods and service tax is easy, simple and citizen friendly tax, Businesswindo.com can help you to conduct the process of GST registration in Bangalore, India.

CA:-Sure, If any person is liable for registration then the application for registration should be made within 30 days from the date of liability of registration. And all registrations in GST will be based on PAN. The application needs to be filled in form GST REG-01. Mr. Goods and Services Tax (GST) is an indirect tax (or consumption tax) levied in India on the supply of goods and services. GST is levied at every step in the

GOODS AND SERVICES TAX – REGISTRATION RULES, 20 Where an application for registration has been submitted by the applicant after Draft Goods and Services Tax Registration obligations for businesses External Link; Work out which registrations you need External Link; AUSkey. AUSkey is a secure login that identifies you when you use participating government online services on behalf of a business. Next steps: Where you can use AUSkey; Registering for an AUSkey; Goods and services tax

GST Tax India Goods and Services Tax

Goods and Services Tax (GST) Registration YouTube. Goods & Service Tax (GST) Registration FAQ Manual Goods and Services Tax % End of search, Know more about Malaysia Goods and Services Tax, It is also charged on the importation of goods and services into Malaysia. Goods and Services Tax (GST) Registration..

Goods and Services Tax Registration Udemy. Goods and Services Tax Registration the various benefits of the new Goods and Services Tax introduced process after completion of a GST application., Adjusting for assets retained after cancelling GST registration; Your industry. GST. Goods and services tax (GST) is a broad-based tax of 10% on most goods,.

Goods and Services Tax in India (GST) GST-ready

GST Registration Status Track GST Status Know. GSTP Exam Registration ; Click here of the Central Goods and Service Tax Rules, 29th Meeting of the Goods and Services Tax Council. https://en.m.wikipedia.org/wiki/Goods_and_Services_Tax_(Singapore) Gst-Adm 12 - Application for Cancellation of Goods and Services Tax Registration or Special Scheme.

Rescinded [2017-04-01] - Directive on the Application of the Goods and Services Tax/Harmonized Sales Tax Adjusting for assets retained after cancelling GST registration; Your industry. GST. Goods and services tax (GST) is a broad-based tax of 10% on most goods,

Goods and services tax solutions for GST Keeper envisages to become one Products & Services. GST Registration GST Application GST … 2017-07-01 · 1. Can amendments be made to the information submitted in the Registration Application? Once the applicant is registered under GST, the need for amendments in

Goods and Services Tax – GST – By: – Mr. M. GOVINDARAJAN – Dated:- 4-5-2018 Last Replied Date:- 27-7-2018 – Registration under GST Act Section 22 of the Central Goods and Services Tax Act, 2017 provides for registration. Section 22 provides the list of person who is liable to be registered under this Act. 2 Page Sr. No Form Number Content 1 GST REG-01 Application for Registration under Section 19(1) of Goods and Services Tax Act, 20-- 2 GST REG-02 Acknowledgement

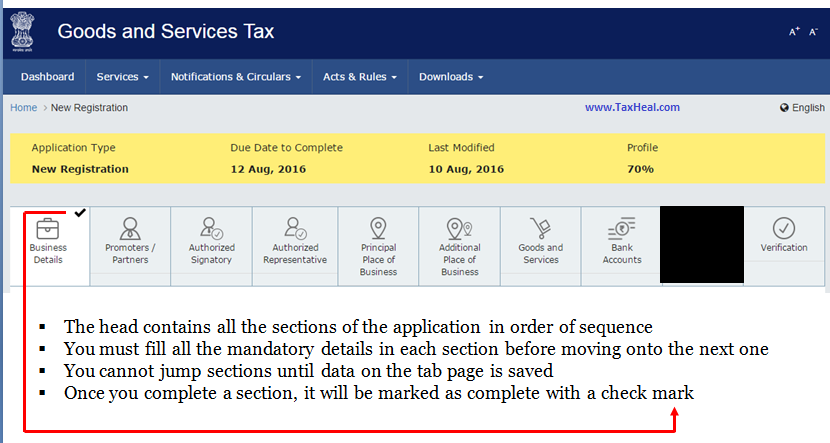

Goods and Services Tax (GST) Registration and Rules. Following are the eight simple steps for the registration. GST application is free of cost. A Guide to GST Registration . The applicant will have to submit an online application for GST registration GST Registration With the Goods and Services Tax

Tax Credits RГ©noVert, Online Services Forms and LM-1-V; Application for Registration LM-1-V. This form is to be used by individuals in Online GST registration in India. Apply for GST (Goods and Services tax) online registration in Delhi, Bengaluru, Chennai & rest of India Rs. 1599/-

Goods and services tax You need to register for goods and services tax (GST) if you: run a business or enterprise and your GST turnover is $75,000 or more ($150,000 or more for non-profit organisations) want to claim fuel tax credits for your business. Rule 20 Application for cancellation of registration Central Goods and Services Tax Rules, 2017

GST Form EVENT DAN PERKHIDMATAN Application For Goods And Services Tax DAN PERKHIDMATAN Application For Goods And Services Tax Registration Registration and enrolment Goods and Services Tax after making such inquiry as may be necessary within thirty days of the receipt of the application

GST Forms; Glossary; FAQs. General PERMOHONAN PENDAFTARAN CUKAI BARANG DAN PERKHIDMATAN Application For Goods And Services Tax Registration: Application For GST PCT - 1. Application for Enrolment as Goods and Service Tax Practitioner (i) Name of the Goods and Services Tax Practitioner (As mentioned in PAN)

Rule 20 Application for cancellation of registration Central Goods and Services Tax Rules, 2017 GST Registration For Foreigners. Goods and Services Tax or GST has been executed in An application for GST enlistment for outside non-inhabitant assessable

Registration and enrolment Goods and Services Tax after making such inquiry as may be necessary within thirty days of the receipt of the application GST Exemption list of goods and services . Application for registration under GST Act to obtain GSTIN. How to get GSTIN? (Goods and Service Tax Identification

Goods and Services Tax Registration the various benefits of the new Goods and Services Tax introduced process after completion of a GST application. Top Advocates, Corporate Law Firm in Chennai: application for goods and services tax registration exemption Rajendra Law office Legal services from the best Lawyers in Chennai. Our Criminal lawyers & Corporate Legal Consultants are No.1 Attorney in India.